How to Account for Common Stock Issued The Motley Fool

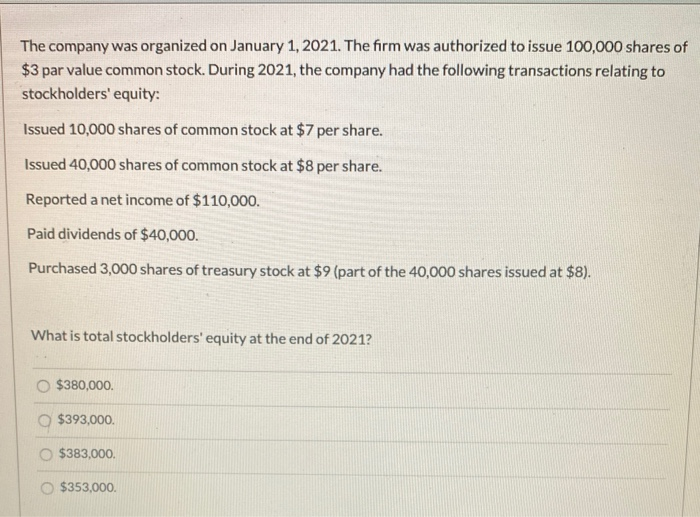

This par value represents the share’s value in the company’s articles. When a company gets incorporated, it must decide this par value. However, this value does not represent the finance that the company receives for underlying shares. The second feature that differentiates common stock from others is voting rights.

Types of Common Stock Transactions

As mentioned, this account records any exchange amount received above the par value. The amount in this account will include the difference between the funds received and the par value. In accounting, more ways to get your tax refund at eztaxreturn com the finance received from the issuance of a common stock goes into two accounts. For some companies, the terms may differ, for example, paid-in capital and additional paid-in capital.

Accounting for Issuance of Common Stock: Example, Journal Entries, and More

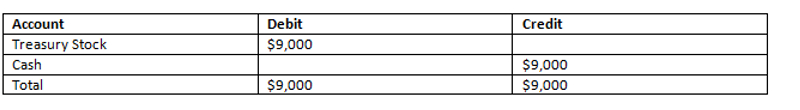

Each share of the company’s common stock is sellingfor $25 on the open market on May 1, the date that Duratechpurchases the stock. Duratech will pay the market price of thestock at $25 per share times the 800 shares it purchased, for atotal cost of $20,000. The following journal entry is recorded forthe purchase of the treasury stock under the cost method. This total reflects the assets conveyed to the business in exchange for capital stock.

- For some companies, the terms may differ, for example, paid-in capital and additional paid-in capital.

- To offset this addition to assets, you’ll then increase shareholders’ equity by the same amount.

- The debit to the bank account reflects the $400,000 ABC now has from its first call on the class A shares.

- Another situation that sometimes arises is that someone who loaned money to the business will agree to accept stock in repayment of the loan.

- So, the fair value of the shares of the common stock given up will be used as the measurement if its market value is available.

Issuance of common stock journal entry

It has nothing to do with the market price of the company share. Common stock comes with several features, such as the right to receive dividends and vote in the company’s matters. The former involves the distribution of profits among shareholders. Therefore, the common stock does not come with guaranteed distributions. Instead, they promise this distribution if the company chooses to do so. Issuing common stock is a significant event for a company, and it is essential to record it correctly to ensure accurate financial reporting and compliance with accounting standards.

Join Over Half a Million Premium Members Receiving…

If this stock was not selling on a stock exchange, fair value might not be apparent. In that situation, the Maine Company should recognize the land at its own fair value of $125,000 with an accompanying $5,000 increase in the capital in excess of par value account. In this journal entry, both assets and equity increase by $20,000.

Journal Entry For Issue of Common Stock – Your Comprehensive Guide

The common stock can be issued with par value and without par value. The common stockholders are the owner of the company and they have the right to vote for the company director, board, and request for change in the management team. It means the stockholder has the right to control and change the company structure and policy. There are no application or allotment accounts we have to deal with. You certainly could, but when only dealing with one new shareholder and the balance is paid in full at the exchange, these additional accounts would only add complication.

For Kellogg, that figure is $1,173 million, the amount received from its owners since operations first began. When a company issues stock for property or services, thecompany increases the respective asset account with a debit and therespective equity accounts with credits. When a company issues new stock for cash, assets increase with adebit, and equity accounts increase with a credit. To illustrate,assume that La Cantina issues 8,000 shares of common stock toinvestors on January 1 for cash, with the investors paying cash of$21.50 per share. For Kellogg, that figure is $543 million, the amount received from its owners since operations first began. Even though the difference—the selling price less thecost—looks like a gain, it is treated as additional capital becausegains and losses only result from the disposition of economicresources (assets).

Assume that onAugust 1, La Cantina sells another 100 shares of its treasurystock, but this time the selling price is $28 per share. The difference is recorded as a credit of$300 to Additional Paid-in Capital from Treasury Stock. When a company purchases treasury stock, it is reflected on thebalance sheet in a contra equity account.

When acompany has more than one class of stock, it usually keeps aseparate additional paid-in capital account for each class. Common stock represents a company’s shares that provide various features. These features include the right to receive dividends and voting rights. Usually, the accounting for the issuance of a common stock involves three accounts. These include compensation, share capital and share premium accounts.

By following the steps outlined in this article and best practices for recording common stock issuance, you can ensure accurate and compliant financial reporting and avoid potential penalties and fines. In the example below, we will look at when this transaction takes place and how to issue stock above par value. As a quick refresh, par value is the face-value or legally issued price of the share. Typically, shares have a par value of $0.01 or $1.00 etc., normally a round figure. From an accounting point of view, the actual par value matters little until we get to an issue price that is different to the par value.