Current Cash Debt Coverage Ratio Formula & Example

This includes turning over inventory more quickly, holding less inventory, or not prepaying expenses. A higher cash coverage ratio indicates that a company has sufficient cash flow from its operations to cover its interest expenses, reducing the risk of default on its debt obligations. In general, a cash coverage ratio of 1 or higher is considered satisfactory, as it indicates that a company can meet its interest payments without relying on external financing. However, it’s important to consider industry norms and a company’s specific financial situation when evaluating its cash coverage ratio. The calculation of a company’s current cash debt coverage ratio aids lenders in assessing the company’s capability to repay debts. The calculation also helps investors evaluate the firm’s liquidity position and future operations considering that they receive quarterly or annual financial reports containing this information.

FAR CPA Practice Questions: Debt Covenant Compliance Calculations

After almost a decade of experience in public accounting, he created MyAccountingCourse.com to help people learn accounting & finance, pass the CPA exam, and start their career. If you choose to use this ratio in your investment analyses, you should always make sure freshbooks review that its value is valid. Let’s look at an example of how this powerful ratio can provide you with some useful information when evaluating a potential investment. However, stakeholders must compare this information with similar companies to obtain better information.

Cash Flow Coverage Ratio

It may be advantageous for a company to reduce its cash ratio in these cases. Identifying the cash coverage ratio assists organizations in finding revenue opportunities. Shareholders can also use this ratio to forecast future financial performance. Coverage ratios are also useful when comparing one firm to its competitors. Evaluating similar firms is critical since an acceptable coverage ratio in one area may be considered dangerous in another. If the company you’re considering appears to be out of step with significant rivals, this is usually a warning indicator.

Cash Flow to Debt Ratio

Firstly, the interest ratio is calculated by dividing EBIT by interest payment. Secondly, the debt service ratio is calculated by dividing operating income by total debt. Thirdly, the asset ratio is calculated by (tangible asset – short-term liabilities)/total debt, and cash coverage is calculated by (EBIT + noncash expense)/interest expense. After dividing one by our company’s cash flow coverage ratio (CFCR), the time necessary for the company’s operating cash flow (OCF) to fulfill its total debt balance is implied to be 4 years.

Debt Service Coverage Ratio (DSCR)

This means that Company XYZ generates five times more cash through its operating activities than it needs to meet its interest expenses. Such a high ratio indicates strong financial health and suggests that the company is well-positioned to meet its debt obligations. The times interest earned (TIE) ratio, on the other hand, measures a company’s ability to service its long-term debt without resorting to financing options such as additional borrowing or asset sales. These explore various aspects of a company’s ability to repay financial obligations. If the total debt balance is assumed to be $260 million, the cash flow coverage ratio is 25.0%.

- These assets are so close to cash that GAAP considers them an equivalent.

- This may be crucial when you apply methods to increase your cash coverage ratio.

- In contrast to the CCR, the current CDCR points to the income statement.

- The company is very capable, I would recommend Assets America to any company requiring commercial financing.

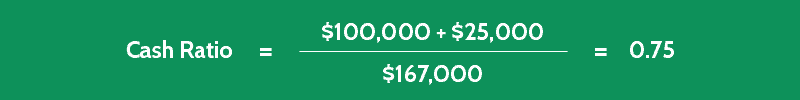

Similarly, ABC Co.’s income statement included an interest expense of $25 million. The company can begin paying expenses with cash if credit terms are no longer favorable. The company can also evaluate spending and strive to reduce its overall expenses, thereby reducing payment obligations. The cash ratio varies between industries because some sectors rely more heavily on short-term debt and financing such as those that rely on quick inventory turnover. The cash coverage ratio is one approach organizations can use to calculate their assets.

Coverage ratios are also valuable when looking at a company in relation to its competitors. Comparing the coverage ratios of companies in the same industry or sector can provide valuable insights into their relative financial positions. However, it’s imperative that you only evaluate similar businesses; a coverage ratio that’s acceptable in one industry may be considered risky in another field.

A higher ratio indicates that the business is in a stronger position to repay its debt. Some of the popular ratios include debt coverage, interest coverage, asset coverage and cash coverage. Coverage ratios are used as a method to measure the ability of a company to pay its current financial obligations.

The cash coverage ratio is of significant importance for companies and stakeholders. Most importantly, this ratio provides creditors with critical information regarding a company’s ability to repay debt. A company has more cash on hand, lower short-term liabilities, or a combination of the two. It also means a company will have a greater ability to pay off current debts as they come due. The cash ratio is almost like an indicator of a firm’s value under the worst-case scenario where the company is about to go out of business.

The value of 1.00 of the cash coverage ratio means the company has the cash and cash equivalent equal to the interest expenses. Thus, the higher value of the cash coverage ratio, the more cash available for the interest expenses, and vice versa. In general, a cash ratio of 1 or higher represents a positive scenario, and tells you that the business you’re assessing can cover its current debts by using cash alone. Let’s dive into how the cash coverage ratio is used to evaluate the company’s liquidity. Companies can identify opportunities to improve their cash flows by calculating this ratio.

Finance Strategists has an advertising relationship with some of the companies included on this website. We may earn a commission when you click on a link or make a purchase through the links on our site. All of our content is based on objective analysis, and the opinions are our own. A business usually shuts down due to a liquidity crisis rather than low or no generation of profits.